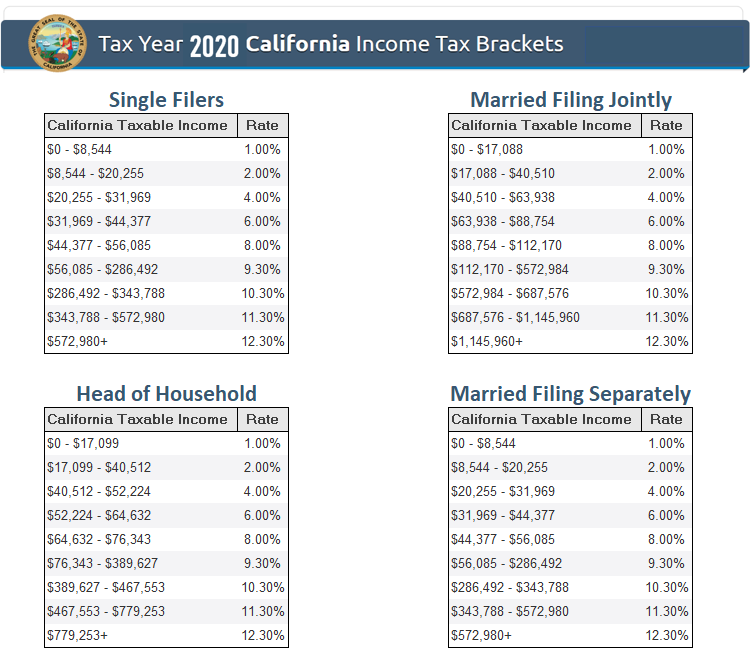

Tax Brackets 2025 California Calculator Online. There are seven federal income tax brackets, ranging from 10% to 37%. This page has the latest california brackets and tax rates, plus a california income tax calculator.

There are seven federal income tax brackets, ranging from 10% to 37%. This page has the latest california brackets and tax rates, plus a california income tax calculator.

Tax Brackets 2025 California Calculator Excel Download Mona Sylvia, Before filing your california income tax return, you should find out the right tax bracket for your state.

2025 California Tax Brackets Table Ronni Raeann, The annual salary calculator is updated with the latest income tax rates in california for 2025 and is a great calculator for working out your income tax and salary after tax based on a annual.

California State Tax Brackets 2025 Calculator Micki Francisca, This tool is freely available and is designed to help you.

California Tax Brackets 2025 Catina Chelsie, The 2025 tax rates and thresholds for both the california state tax tables and federal tax tables are comprehensively integrated into the california tax calculator for 2025.

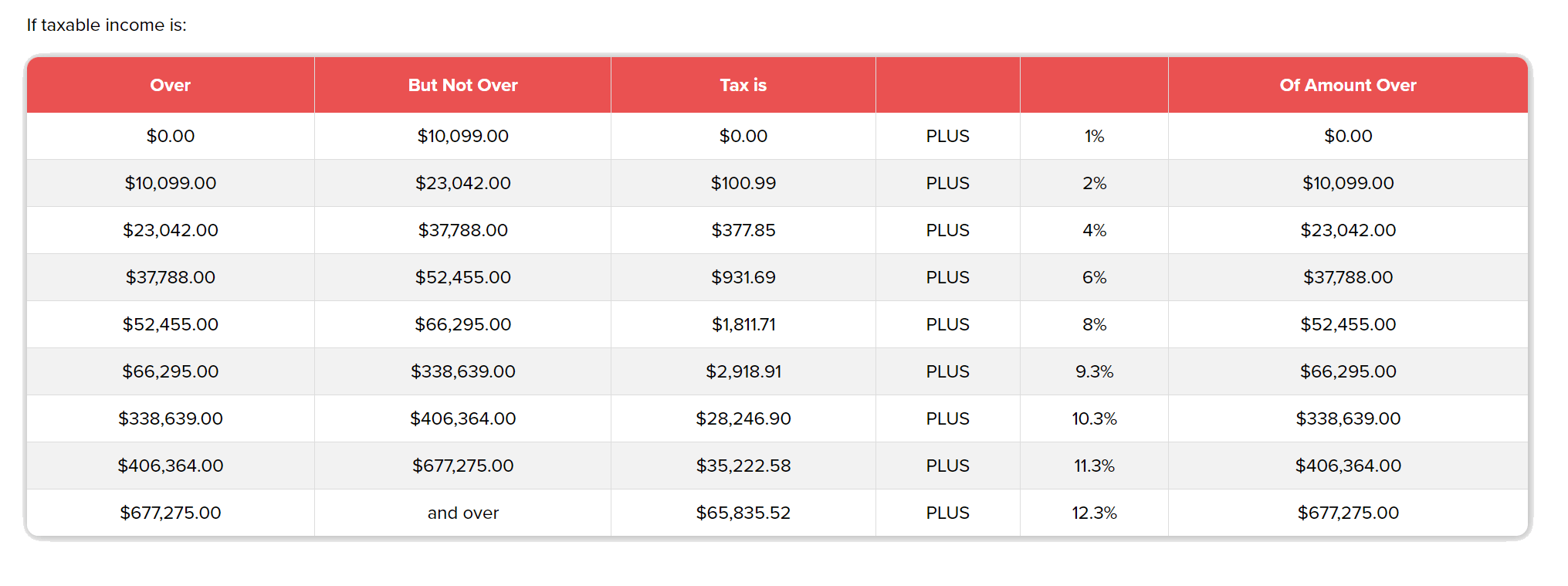

Tax Brackets 2025 California State Nessi ZsaZsa, The tax brackets and rates below are used to calculate taxes for people whose taxable income was over $100,000 in 2025.

California Tax Brackets 2025 Married Filing Jointly Aggie Sonnie, Our tax calculator will calculate your tax depending upon the income tax bracket and filing status provided by you.

California State Tax Brackets 2025 T3 Adena Arabela, A california income tax calculator can help you determine this.

Tax Brackets 2025 California Calculator Online Valma Jacintha, How to calculate federal tax based on your annual income.

2025 Tax Bracket Calculator Jana Rivkah, You are able to use our california state tax calculator to calculate your total tax costs in the tax year 2025/25.

California Tax Brackets 2025 Calculator Cate Marysa, Brackets are part of a progressive taxation system that charges increasingly higher rates on higher tiers.