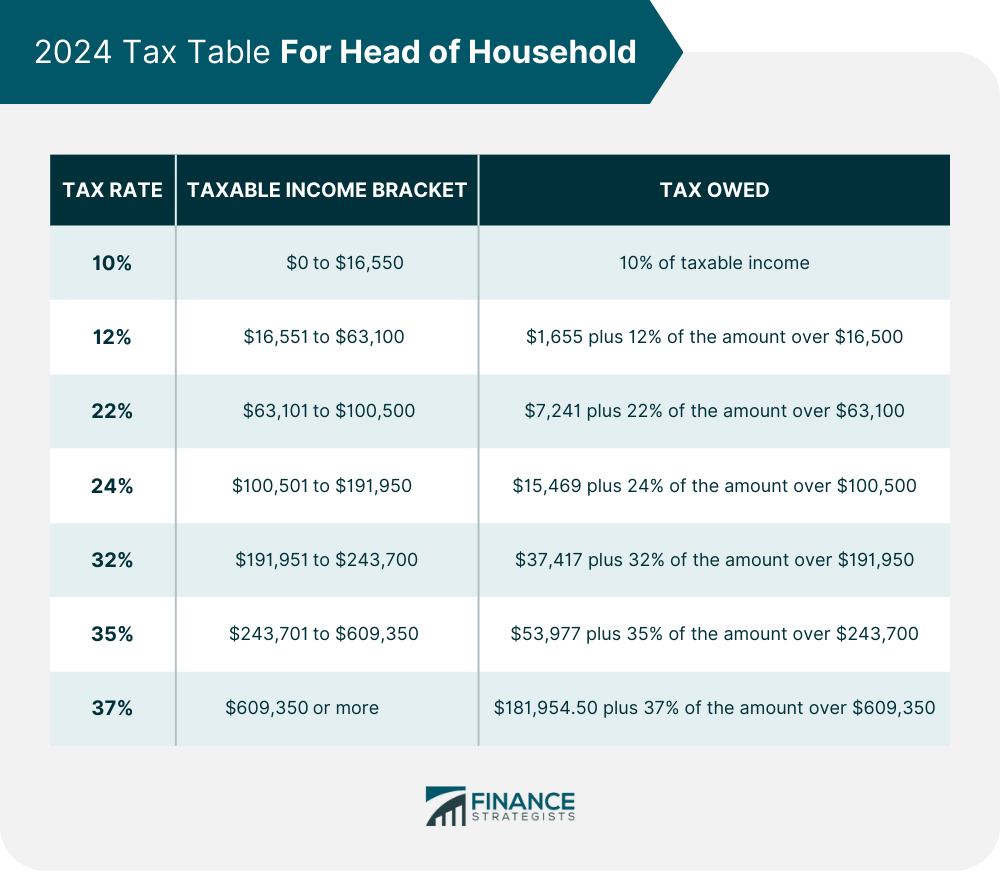

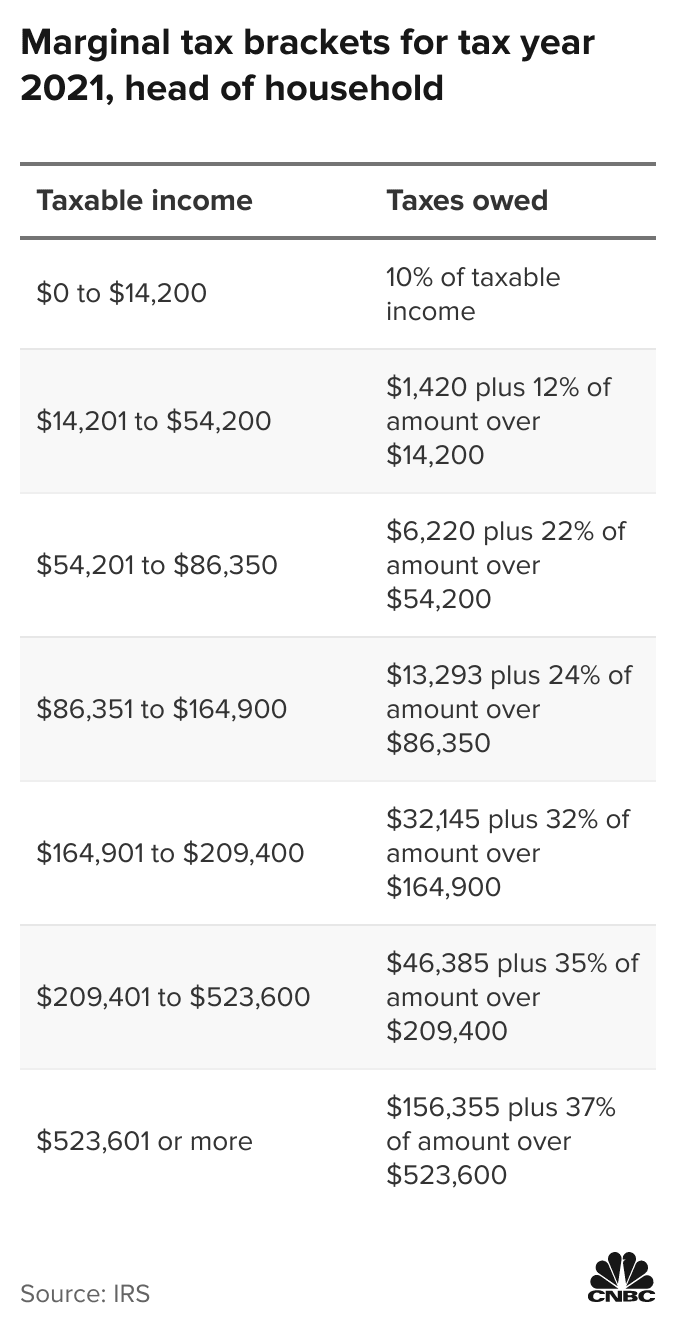

Tax Brackets For 2025 Head Of Household Life. To figure out your tax bracket, first look at the rates for the filing status you plan to use: How to file your taxes:

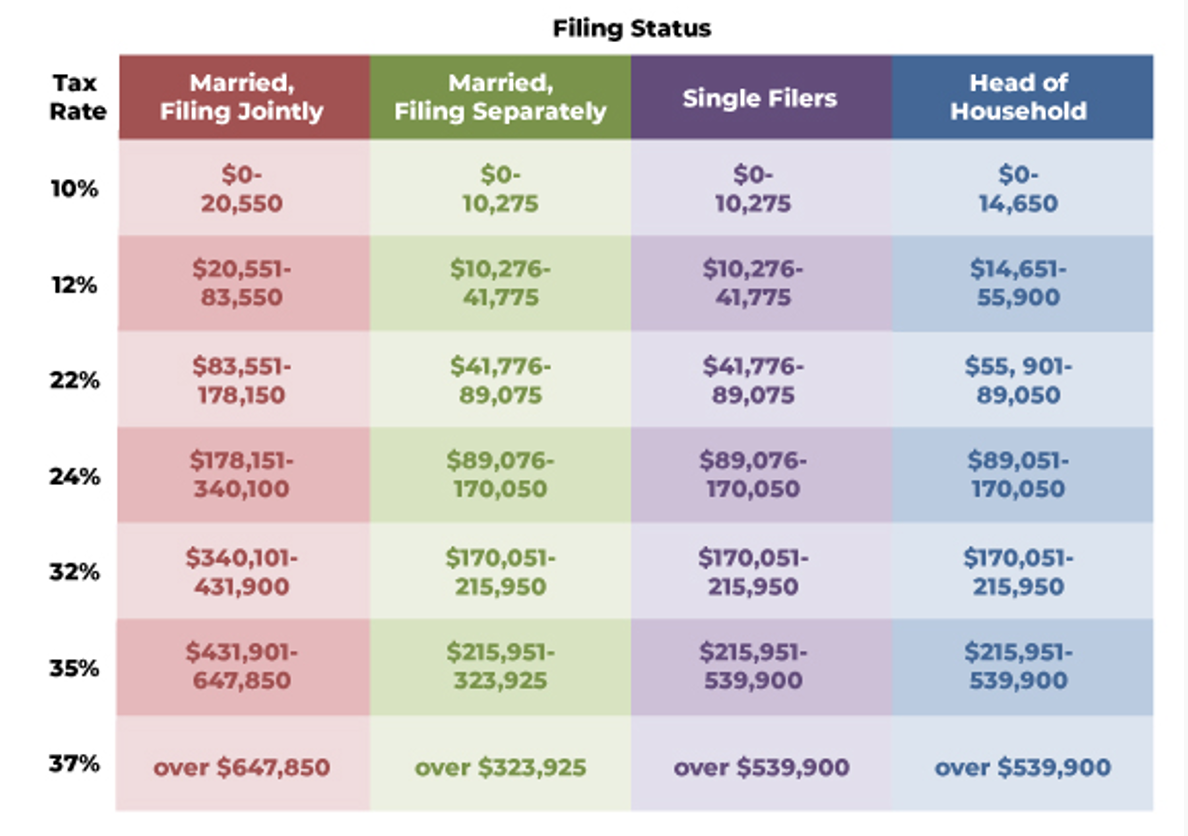

10%, 12%, 22%, 24%, 32%, 35% and 37%. There are different tax brackets for single filers, married couples filing jointly, heads of household, and married couples filing.

Tax Brackets 2025 Head Of Household Single Pammy Christiana, Here are other changes to keep in mind during tax season.

Tax Brackets Definition, Types, How They Work, 2025 Rates, 10%, 12%, 22%, 24%, 32%, 35% and 37%.

2025 Tax Brackets Single Head Of Household Dorrie Scarlett, Tax brackets are the same for everyone.

Irs Standard Deduction 2025 Head Of Household Sonia Eleonora, The federal standard deduction for a head of household filer in 2025 is $ 21,900.00.

Tax Brackets 2025 Head Of Household Ange Maggie, Here are other changes to keep in mind during tax season.

2025 Tax Brackets Single Head Of Household Inez Madeline, The rebate will be 50% of tax payable, capped at $200.

2025 Tax Brackets Head Of Household Over 65 Elita Nancie, Tax rate taxable income (married filing separately) taxable income (head of.

Tax Brackets 2025 Head Of Household In India Amber Bettina, Your bracket depends on your taxable income and filing status.

Irs Tax Brackets 2025 Head Of Household Erinna Zsazsa, Married couples filing separately and head of household filers;